Bitcoin Market Update: BTC Eyes $90,000 With Strong Support at $84,000

Bitcoin

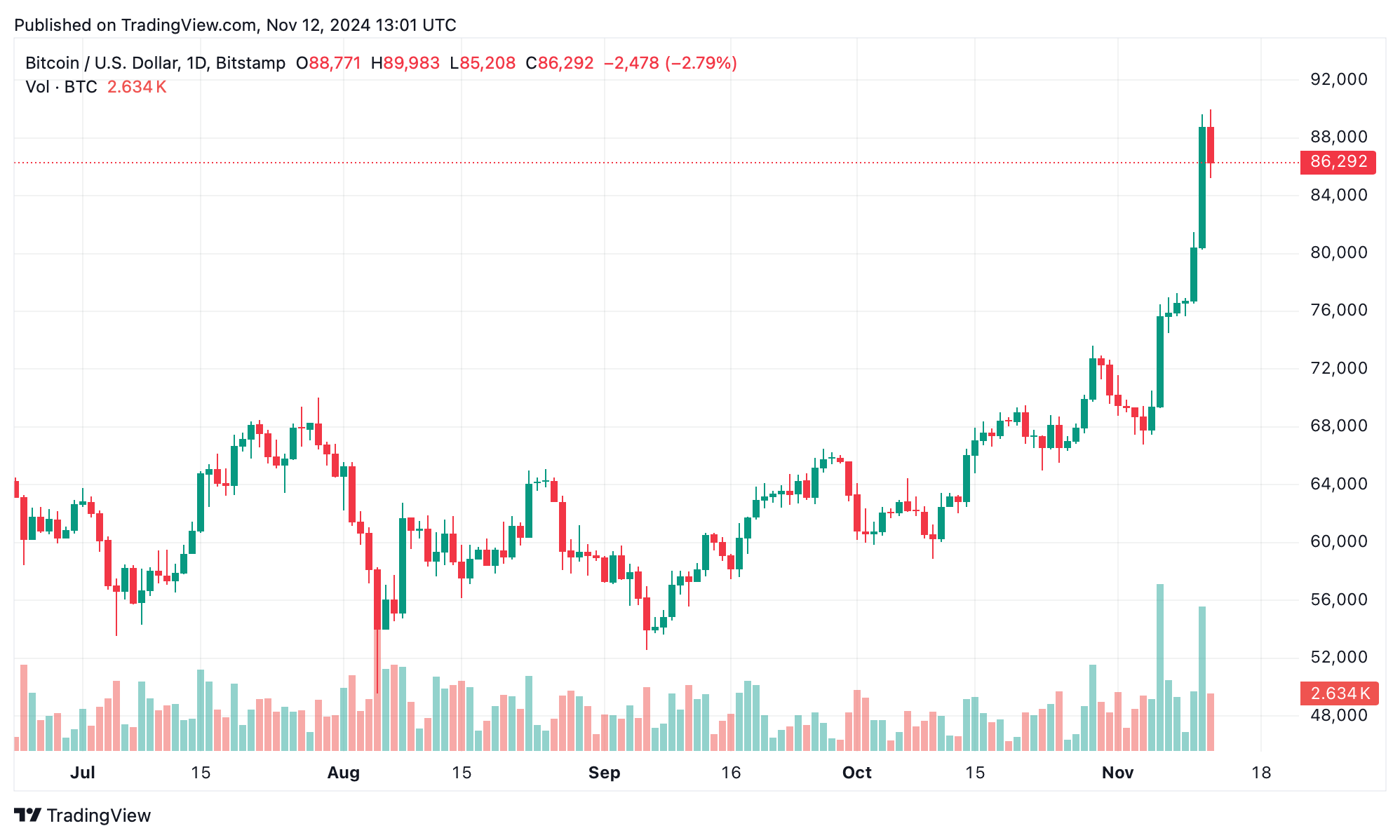

On the daily chart, bitcoin’s bullish momentum is evident, with prices soaring from approximately $60,000 to a peak near $90,000. This substantial gain shows continued demand; however, the most recent daily candle displays a large red body, hinting at a possible pullback. The relative strength index (RSI) sits in the overbought territory at 79, a classic oscillator suggesting that buying momentum may be waning. As bitcoin flirts with $90,000, a potential short-term consolidation or correction could be on the horizon.

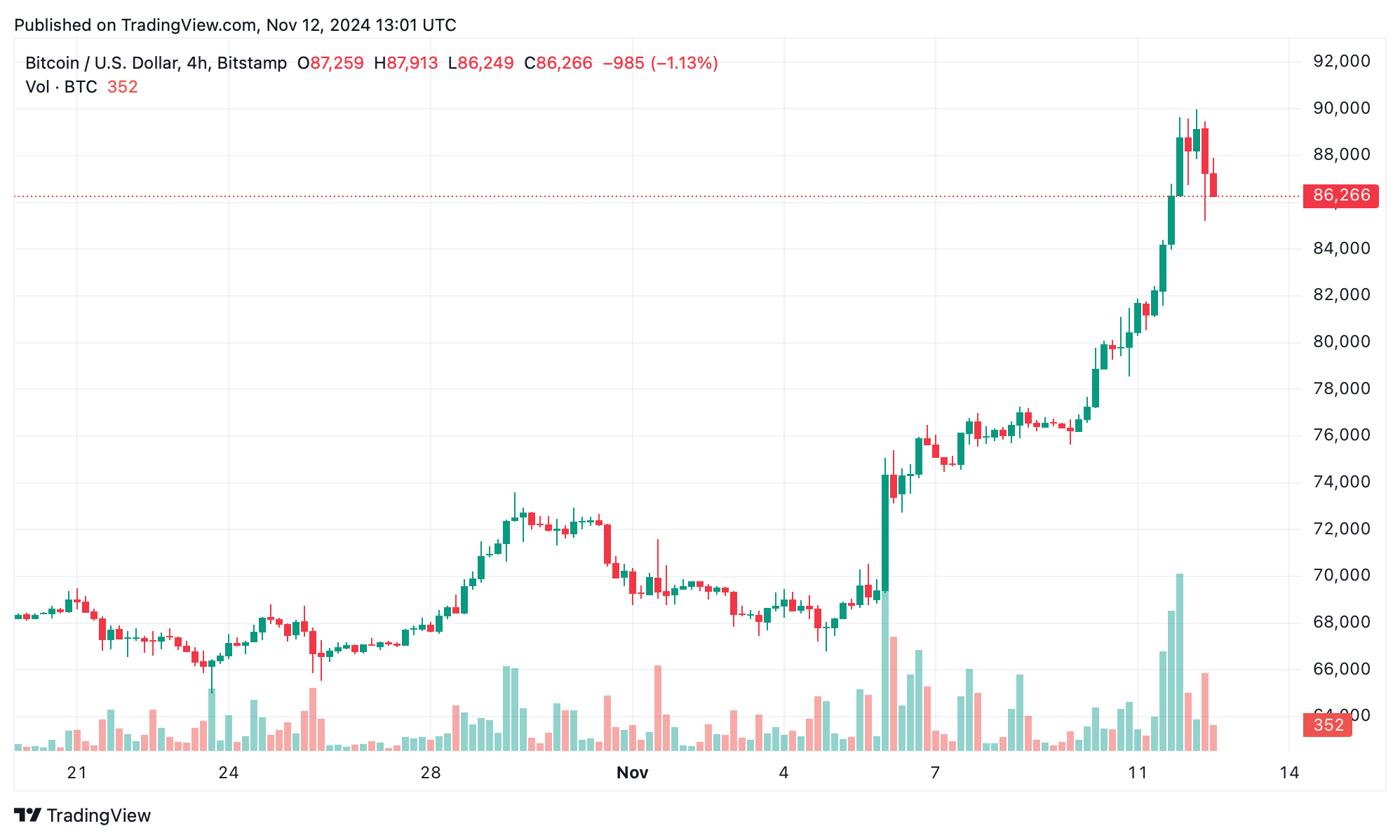

BTC/USD 4-hour chart.

Examining the 4-hour chart, we see a similar bullish structure with higher highs and higher lows. After reaching the $89,983 resistance level, a sharp red candle formed, indicating active selling pressure. The Stochastic oscillator is at 92, which further reinforces a sell signal. Volume data reveals increased activity on these red candles, adding weight to the bearish outlook and possibly signaling a shift from bullish dominance to a more cautious approach by traders.

BTC/USD daily chart.

On the 1-hour chart, bitcoin’s short-term movements show increased volatility following the peak. The price corrected sharply, then stabilized around $86,000, creating a support level visible in both the 1-hour and 4-hour charts. The moving average convergence divergence (MACD) level shows a positive buy signal at 4,581, suggesting potential for a continuation of the broader trend. However, the average directional index (ADX) remains neutral at 32, indicating that momentum may be insufficient for a significant move higher without further consolidation.

Key support and resistance levels are emerging. The immediate support lies at $86,000, where recent corrections paused. The next significant support level appears on the daily chart around $80,000, a prior breakout point. Resistance sits firmly at $89,983, bitcoin’s recent high, with a psychological barrier at $90,000. Breaking past these levels with substantial volume would be a bullish continuation signal, while failure to break resistance could lead to a short-term consolidation phase.

The Cryptoquant chief added:

This led to price swings in the last bull cycle so many times. Now, almost no volume above $72K—easy up, easy down.